Originally posted September 5, 2016. Updated November 16, 2020.

I have become my mother’s keeper. I am still surprised at how fast it happened. It was as if I had climbed up a steep hill and before I had a chance to catch my breath – the earth started crumbling underneath me; causing me to run like hell – scrambling to find safe ground.

In 2014, my then 83-year old mom was relatively self-sufficient and in good health mentally and physically. There were minor signs where she gave me moments of disquiet, but my mom and I handled them. Then in Spring 2016 she got dizzy and fell; resulting in facial and arm fractures. At the time I thought it could have been worse and that she would recover. She healed physically, but changed mentally and emotionally. She has gone from being an independent person and I’ve become more than just her daughter who lives out-of-state. I am now responsible for my mom’s custodial, medical and financial care.

For some adult children they may have more than two years before they find themselves taking care of an elderly parent or relative. Others wish they had two years instead of the months, weeks or even days before the caregiver role was thrust upon them. Most of us are not fully prepared for this role, even those who think they are prepared soon discover that is far from the case.

Who are Caregivers?

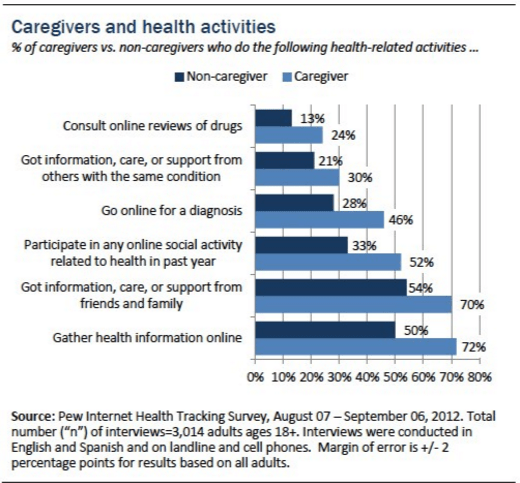

According to a 2013-2014 Bureau of Labor Statistics Survey there are “40.4 million unpaid eldercare providers (caregivers of adults ages 65 and older) in the United States.” Along with the ever-increasing number of caregivers has also been a change in the role and responsibilities of caregivers, which has gone from simply checking-in on an elder to more complex duties.

A 2013 Pew Research Center survey reported that the role of caregivers “encompasses everything from buying someone groceries and managing their finances to helping them with bathing, dressing and other tasks of daily life.” In a 2012 survey conducted by the American Associate of Retired Persons’ AARP Public Policy Institute and the United Hospital Fund stated that the role of family caregivers “has dramatically expanded to include performing medical/nursing tasks of the kind and complexity once only provided in hospitals.”

Adjusting While Learning

It has been an unexpected transition for myself – since like most kids you expect your parent(s) to grow old, yet still be somewhat the same. That has not been the case for my mother. I have watched my mom transition into various stages: from living on her own to post-surgery recovery then rehabilitation; acknowledging that she can no longer live on her own; not wanting to relocate out-of-state to live with her daughters to accepting that she will be in a senior care facility for the foreseeable future. In the interim, I have spent a lot of time with my mother while also interacting with her physicians, friends and business contacts on top of our family members. I have had to deal with a lot of information and make short and long-term decisions regarding my mom. Luckily family and most of my mom’s friends still live in the same city/state as my mom – so they have been my eyes and ears concerning my mother. At times it has not been easy, but I have learned a lot on the way. Most importantly, I am glad that I have been able to be there for my mom.

Below are some tips (NOT legal advice) for those who may find themselves having to take care of an aging or sick parent/relative. Keep in mind, there is always going to be a new or unexpected situation that will arise when caring for your parent. However, these initial tips will save you some initial pain as you begin this journey.

……………………………………………………………………………………………………………………………………………………..

COMMUNICATION/ACCESS

1. Talk and Listen to Your Parent– If you have a decent-to-great relationship with your parent, then that is half the battle in being a good caregiver. However, when you do talk to your mother or father make sure to talk to him/her about what is going on with them day-to-day. Not just in generalities, but the details (i.e., what’s bothering them physically, emotionally, financially; their doctor appointments; prescribed medications; friends; activities; errands they usually run, etc). Find out who they talk to and spend time with when you are not around or available. Don’t turn it into an interrogation; which may inadvertently put them on the defensive. Just make sure to be fully-engaged in the conversation, which means having your listening ears on, asking questions and being patient. If/when you have to step-in for your parent due to an accident or an emergency you will have a better grasp of what is going on with him/her, which will be important when speaking with medical professionals.

2. Add Your Parent’s Phone Contacts To Your Phone – Your parent’s contacts are those individuals whom you have heard him/her mention more than a few times such as friends, doctors, acquaintances, former co-workers, physicians, organizations, and businesses. Your parent’s contacts may be listed in his/her personal phonebook or their cellphone/smartphone (if they’re a member of the digital age). Adding their contact information (names, phone numbers, home addresses, emails) to your smartphone (or having them written down in a notebook) will make it easier to reach out to them, if necessary, concerning your parent.

3. Provide Your Parent’s Close Friends With Your Contact Information – Your parent’s friends will want to visit your parent, to check up on them and make sure they are doing okay. It is important that they have your contact information (name, phone numbers, email address), especially if you live out-of-town. Your parent’s friends can let you know how your parent is doing or if something is amiss. They can be a valuable asset information-wise in helping you take care of your parent. Don’t wait for them to call you, make a point of calling them as well. They will appreciate that you care.

4. Keep Family Members In the Loop Regarding Your Parent’s Care – If you happen to live some distance from your parent, you will need back-up to help you take care of your parent. Your ‘back-up’ could be a family member, friend of your parent or members of her community – anyone who have expressed interest in helping you take care of your parent. Use phone calls, texts or detailed FYI emails to keep everyone updated regarding your parent’s care. This type of information exchange will make sure that everyone is on the same page information-wise concerning your parent’s care, especially when interacting with medical staff.

5. Make Copies of Key(s) To Your Parent’s Home – Having access to your parent’s home will make it easier to take care of your parent during an emergency. The last thing you want to be doing is scrambling around trying to find her landlord, a locksmith or a family member to help you gain entrance to your parent’s home. If your parent has his/her own home then duplicating the key is a simple task. However, if he/she lives in an apartment and has a master key (which prohibits duplication) you might have to pay for a duplicate key via the property manager. If you live out-of-town from your parent, it is probably a good idea to provide a trusted family member or friend with copies as well. Note: If your parent has other areas that require access (i.e., car, mailbox, home security) make sure you have the keys and codes to those as well.

MEDICAL CONCERNS

1. Go to Medical Appointments With Your Parent – Meeting your parent’s general/primary care physician and specialists in-person (even if it’s only once) are golden opportunities to get to know your parent’s doctors, ask questions about your parent’s health and remain in-the-loop in regards to your parent’s medical care. Plus, once you have met the physicians and staff it will be easier to get updates and information via phone calls because they have met you, which is especially beneficial if you don’t live in the same area as your parent.

2. Take Notes When Meeting With Medical and Administrative Staff – Unfortunately, the medical profession has a bad habit of dispensing information and medical terminology much too fast to its patients, especially its elderly ones, for them to grasp readily. If you happen to be hospitalized it is even worse because physicians and nurses sometimes fail to identify themselves (i.e., name, title/medical specialty) and tell you succinctly when you’ve been prescribed X or need to do Y. As your parent’s advocate it is important that you stop physicians, nurses and other medical staff in their communicative tracks with questions (i.e., what is your name, what is your medical connection to my parent, what medication did you provide my parent, etc.) and make sure you write it down and keep records (or get copies) of what you have been told.

3. Get A Copy of Parent’s Most Recent Medical Records – This information is important to have in case of an emergency or when you are dealing with new physicians. If you are in contact with your parent’s primary care physician you should be able to obtain this information readily. Also, if your parent is hospitalized make sure to get a copy of the discharge papers for your records as well. The discharge papers will include important information such as the names and contact information for the physicians who treated your parent, medications prescribed and the procedures that were performed (e.g., surgeries). Note: Some physicians – possibly those you have not met – may request a copy of your Power of Attorney document before releasing your parent’s medical records and/or be willing to speak with you about your parent.

4. Keep A List of Their Medications – You should know what medication (prescriptions and over-the-counter) your parent is taking, its usage and the prescribed dosage. You should be able to get a copy of your parent’s current medication from his/her primary doctor. Another option is to check your parent’s medicine cabinet (or wherever he/she places her medicine) and write down the information. It is also important to know the name and contact information of the pharmacy your parent uses. This information could come in handy in case of a parental emergency if medical staff are in need of an updated prescription list.

FINANCIAL/BUSINESS/LEGAL AFFAIRS

1. Have Your Name Added to Your Parent’s Bank Account – You and your parent must be in agreement with this decision, plus you will both have to go to your parent’s bank to make the change to his/her account. Once your name is on the account it will be easier to manage your parent’s finances if/when they are unable to do so (i.e., make online payments/pay bills on their behalf, check for suspicious activity, etc.). This type of access is wonderful if an emergency arises and you happen to not live nearby or out-of-state from your parent. One of the things that will help your parent recover from an accident or hospital stay is knowing that their financial/business affairs are being taken care of while they are temporarily incapacitated.

2. Get Copies of Your Parent’s Banking, Credit Card and Other Financial Statements – It is important that you know your parent’s monthly income (pension, social security, etc.), savings (bank account, CDs, investments) and expenses (i.e., credit cards, utility bills, mortgage/rental payments, life insurance, health insurance, burial plot, etc.). Knowing your parent’s income may be important in terms of how much your parent and/or yourself can afford when selecting a rehabilitation center, nursing facility, assisted living or in-home nursing care for the short or long-term. Also, some rehabilitation and nursing homes will have income-sensitive requirements in order for your parent to become a resident such as 1) financial limit to how much your parent can have available resource-wise (i.e., monthly income, amount in checking and savings accounts, life insurance value, stocks and bonds, etc.) and/or 2) proof of your parent’s expenses in order to determine your parent’s monthly custodial costs (i.e., food, bed, medical care). Therefore, it is important that you have a full understanding of your parent’s financial status.

3. Know Where Your Parent Keeps Treasured Items and Important Papers – You need to know where your parent keeps his/her prized possessions or significant belongings such as their last will and testament, birth certificate, deeds, heirlooms, emergency funds or photos. Do not assume that everything will be in one place or in an obvious location such as a safe deposit box, desk drawer or bedroom closet. Your parent may feel uncomfortable that you are asking him/her about this because it reminds them that they are getting older, but do not let that deter you. You do not want to be in the situation of trying to locate items on your own because your parent is no longer mentally able to provide you with any guidance.

4. Have Your Parent Complete A Living Will or Advance Directive – A Living Will allows an individual to give explicit instructions about when/how medical treatment is to be administered when he/she is injured, terminally ill or permanently unconscious. An Advance Directive pertains to decisions or instructions regarding a patient’s end-of-life care. It is important to have your parent complete a living will or advance directive while he/she still has the mental capacity to do so. Depending on the state, the process can be as simple as your parent filling out a form with a witness and then having both of them sign-it. Other states may require more of a legal step such as a notarized durable Power of Attorney for health care which names you as the person trusted to make health care decision on behalf of your parent. Check your parent’s state-of-residence statutes or guidelines for details and guidance.

5. Make Sure You Have Power of Attorney – A Power of Attorney (PoA) gives you the authority to operate on your parent’s behalf in regards to their medical, financial, business and legal affairs. These ‘affairs’ can range from selling your parent’s home, handling their medical care, canceling cable service, discontinuing utilities, or making monthly bill payments. Most companies will require a PoA from the caregiver in order to cancel any type of service, that is, if the parent is unable to do so himself. Whether a PoA is needed to fully manage your parent’s affairs and what is required to process a PoA varies from state-to-state (i.e., simple letter authorizing PoA, notarized PoA forms, completed PoA forms submitted by a practicing attorney, etc.). It is very important that you check the state’s statute of where your parent resides to find out what is legally required regarding PoA arrangements. If you are still flummoxed about the PoA process, most cities and counties have a Department of Aging that could be helpful. Another option is your local American Bar Association’s (ABA) Pro Bono Section which can help help you through the process. Of course you can also seek out a private attorney via personal contacts or the ABA – an attorney who specializes in elder law to help you with this procedure. Note: Some financial institutions have their own PoA form (separate from the general PoA) that you and your parent might have to complete and have notarized in order to legally access/manage your parent’s bank account(s). Check with your parent’s financial institution regarding their PoA requirements. Banks generally do not post its PoA form online, so you will have to get copy of the form at your parent’s financial institution.

6. Get Legal Authorization to Manage Social Security Checks. More than likely as part of your parent’s income he/she receives a monthly payment (also known as a social security check, social security payment or retirement benefits) from the Social Security Administration, (SSA) a U.S. federal government agency. Since the SSA does not accept the validity of Power of Attorney authorizations, you will have to become a Social Security Representative Payee in order to legally access and manage your parent’s social security checks/payments. Becoming a Payee will require a visit to your local SSA office – the process can not be completed online. You can expedite matters by bringing your parent with you to the SSA office. However, if you and/or your parent are unable to visit the SSA office jointly (e.g., you happen to live out-of-town from your parent, your parent has limited mobility and/or health issues) an SSA customer service representative should provide you with a medical assessment form (determination of your parent’s ability to handle his/her social security checks) to be completed by your parent’s doctor and returned to the SSA. If you are approved by the SSA to be your parent’s Representative Payee, you will receive paperwork from them detailing your custodial rights to manage your parent’s social security payments. Also note, if your name is on your parent’s banking account you will be required to set-up a non-joint account in your parent’s name specifically for SSA online check deposits. This process may seem annoying, time-consuming or unnecessary, but keep in mind that SSA wants to protect “beneficiaries who are incapable of managing their Social Security or SSI (supplemental security income) payments.” Plus this ‘step’ will also give you another layer of protection concerning your parent’s income and finances.

EMOTIONAL WELL-BEING

Take Care of Yourself And Keep in Mind That This Is A Journey – When you find yourself on this road with your parent it will be hectic, tiring, aggravating and disheartening. Your parent will have good and bad days – and when the bad days come you might find yourself the recipient of their anger, depression or hurt. You will also feel like you are not doing enough and too much for your parent logistically, financially, emotionally or spiritually. As a result, there will be times you simply don’t want to spend time with and/or talk to your parent because they have worn you down, made you feel depressed or even angry. These feelings are normal and you should not run away from them, though occasionally it will be hard not to beat yourself up over having them. For some, these feelings are connected to the fact that they miss the way their parent used to be or some of the things they used to do, even if it was just the simple ‘how was your day’ chats. In order for you to manage this phase of your life you can not let it consume your life. Worrying about your parent will always be in the back of your mind, but it is important that you do things to alleviate the pressure such as allowing others to help you, talking to an understanding friend, going to the movies, reading a good book, joining a support group, hanging out with family and friends or simply taking a day to spend time with yourself. You should also make a point of seeing a physician and/or counselor if you are noticing a change in your physical and/or mental health (i.e., loss of appetite, lack of energy, depression, anxiety, resentment, etc.). Remember – in order for you to be able to take care of your parent you have to take care of yourself.

……………………………………………………………….

ADDITIONAL INFORMATION

AARP Resources for Family Caregiving – The American Association for Retired Persons’ (AARP) website has a lot of information for caregivers (e.g. guides, tips, resources, etc.) whether you’re new to the role or are a seasoned caregiver.

American Bar Association Commission On Law and Aging – Has toolkits and information on making legal and healthcare decisions on behalf of an aging parent or relative.

Caring for the Caregiver – PBS resource webpage specifically for caregivers. It includes links to finding support groups, getting started in the caregiver role, and a self-assessment test to help caregivers recognize symptoms of stress and how to take care of themselves.

Five Facts About Family Caregivers – Pew Research facts about “caregivers of older Americans.”

Family Caregiver Alliance Caregiving Across 50 States – Profiles contain each state’s background characteristics related to caregiving and aging as well as information on publicly-funded caregiver support programs.

Mayo Clinic: Living Wills and Advance Directives for Medical Decisions – Information and documents from Mayo Clinic Staff in regards to medical arrangements when “you’re not able to speak for yourself.

Power of Attorney Forms – This website provides ‘power of attorney’ (PoA) form templates for all 50 states. Note: You should only use these forms as a starting point, since the forms may not be current due to changing state PoA laws. Make sure to check 1) the statutes of your parent/relative’s residential state for the most recent PoA laws or 2) an elder law attorney to ensure that your form is accurate and up-to-date.

Propublica Nursing Home Data – Allows you review and compare nursing homes in a state based on the deficiencies cited by regulators and the penalties imposed in the past three years.

U.S. Department of Health and Human Services’ Administration on Aging – Links to information, resources and services regarding older individuals and their caregivers

Understanding the Rules: Medicaid Payment for Nursing Home Care – Booklet designed to provide family and caregivers with “information and answers to some of the [nursing home-related] questions [they] will encounter.”

Start with open communication, prioritize safety, and seek support from healthcare professionals. Regular check-ins and making adjustments as needed are key for both you and your parent’s well-being.

LikeLike

It might be helpful to include some resources or references for readers who are looking for more information or support. For example, local support groups or organizations that specialize in aging and caregiving could be a valuable addition to the article.

https://www.agingparentsupport.com/

LikeLiked by 1 person

I do have some of that info in the ‘Additional Resources’ section of my article 🙂

LikeLike

Incredible blog! Jotting down your emotion in words and sharing ideas of how to take care of old age people by their point of view is truly a tough and magical task. So sequentially mentioned.

LikeLike

I liked how thorough and detailed this post is for taking care of elderly parents. The suggestion about learning their monthly income and expenses was really helpful. That’s a factor I hadn’t thought about including while planning out what type of care my parents while have.

LikeLike

Glad to be of help. It’s important to know what you and/or your parent can afford before you start looking for a nursing facility, retirement home, in-home care, etc. You don’t want to select an option that will be a struggle to pay for on a monthly/regular basis. That’s a type of stress that caregivers nor their parents can afford to have.

LikeLike

This is a wonderful, really thoughtful, and all inclusive post. Thank you for posting it and i wish you luck as you journey into a very difficult job. May you appreciate the beautiful moments and may they get you through!

LikeLike

Thanks for the blog post compliment and kind words 🙂

LikeLiked by 1 person

You are truly welcome.

LikeLike